The “Magnificent Seven”…and their effect on your portfolio

It is a well-known fact around our office that if you want movie advice, Zak is your man, not me. However, I must say that I think the title of my blog post, The Magnificent Seven, sounds like a great action movie title (further research indicates it was…guess I’m not as creative as I thought.) Movies aside, we’re going to focus on a different magnificent seven for this post, Nvidia, Microsoft, Meta (Facebook), Alphabet (Google), Amazon, Apple, and Tesla.

The S&P 500 is comprised of 500 large-cap companies (think big companies.) In addition, their weighting in the index is based on market capitalization, meaning their financial value. The seven companies listed above account for nearly 30% of the S&P 500 index, while the other 493 companies account for the remaining 70%. It is fair to say that those seven companies’ stock performance have a big influence on the returns of the S&P 500, case in point is 2023. As of a July 26th Trendrating report, the stock market was up about 19%, but let’s look closer. According to that same report, the “Magnificent Seven” had an average year-to-date return of 96%, while the other 493 companies? Just 2%.

As a quick aside, here are the individual rates of returns according to Morningstar data for the magnificent seven as of 8/25/23:

Nvidia – 214.94%

Alphabet – 47.21%

Microsoft – 35.53%

Apple – 38.01%

Meta – 137.4%

Amazon – 58.64%

Tesla – 93.69%

Since reports of the “Magnificent Seven” started appearing in the summer, we have seen the market start to broaden its returns, meaning other sectors have performed better over the previous weeks, (before a slight market pullback in the last two weeks.) However, due to their large influence over the stock market the “Magnificent Seven” have set a high bar for the rest of the stock market…including diversified investors.

As someone who used to compete in triathlons, you would often hear the term, the “pointy” end of the race, meaning one of the few out in front (usually not me!) I’ve been referring to this year’s stock market as a “pointy market.” The overall returns of the stock market are a bit deceiving; the return is largely being driven by just a handful of companies at the front.

This type of market has several effects on investors:

The Ripple Effect

The gravitational pull of the “Magnificent Seven” extends far beyond their individual stock values. Each strategic maneuver, corporate announcement, and quarterly report becomes a seismic event capable of sending tremors across a diverse array of sectors. The inception of a groundbreaking product, a change in the helm, or even a mere alteration in regulatory winds from these titans can send shockwaves through the market, evoking a symphony of reactions from investors and financial institutions.

Diversification Can Feel Disappointing

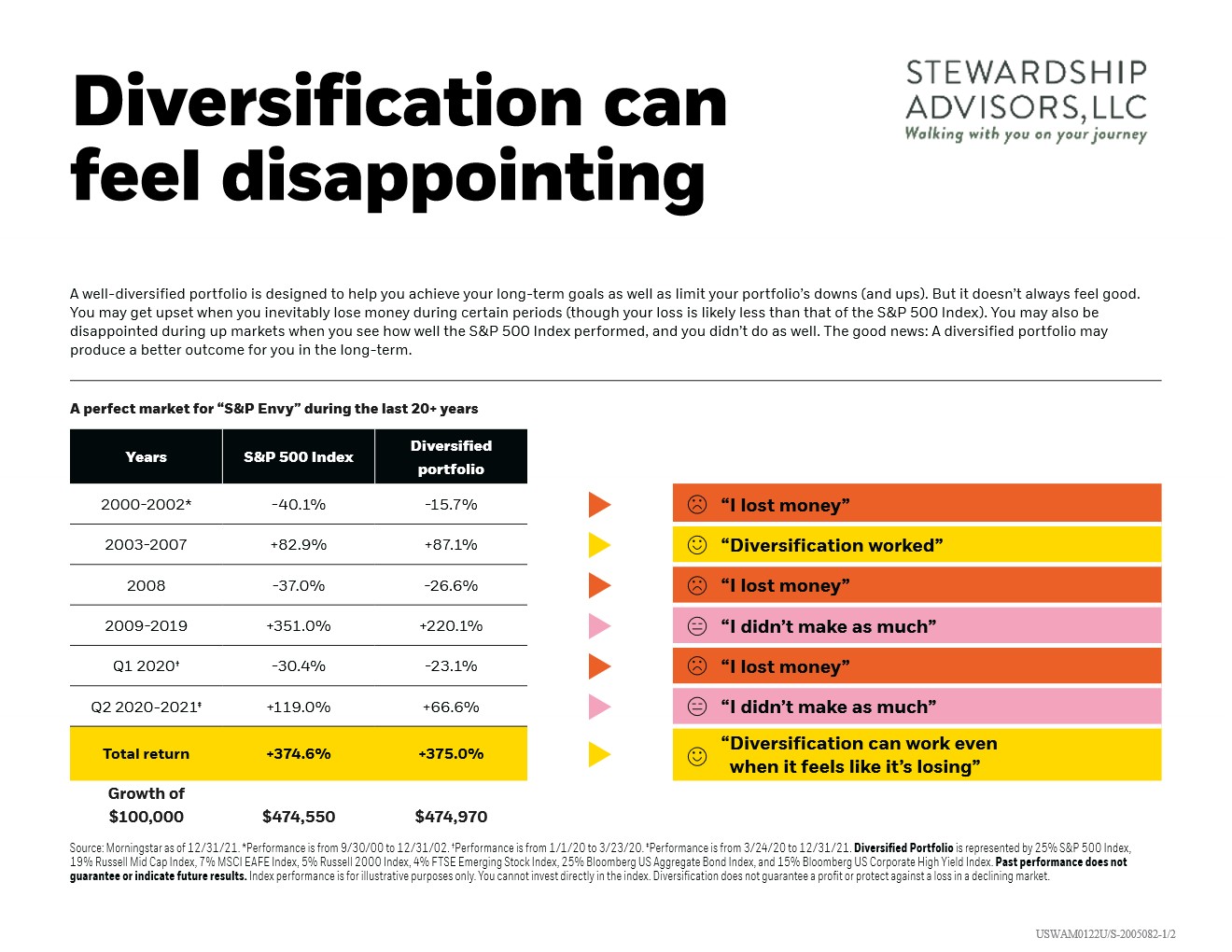

When crafting a portfolio tailored to your aspirations, diversification – the golden rule of not putting all your eggs in one basket – takes center stage. Yet, in the realm of investing, diversification seldom brings an unblemished sense of satisfaction. In fact, it might just be that a diversified portfolio never truly feels like a resounding success. When the market soars, questions arise about why your investments are not soaring in tandem. Conversely, market downturns might sour your mood despite your portfolio’s comparative resilience. BlackRock refers to this as “S&P Envy.” Looking at the chart below, it reveals a pattern where diversification seems to slightly lag during market upswings and offers a modest buffer during downturns. These conflicting emotions can cloud our perspective that over the long term, a diversified portfolio may outperform the stock market.

Dominant Stocks Demand Prudence

While the dominance of these seven stocks in steering market trends is undeniable and demands our attention, it’s imperative that we approach this scenario with a cautious eye. Overreliance on this exclusive group could expose investors to heightened risks, particularly when confronted with sudden shifts in market sentiment. While their impact is substantial, let’s not stray from the cardinal principles of prudent investing – a diversified portfolio and shrewd risk management. For example, while Nvidia has had quite a rise this year, in 2022 it was down -50.26%, Meta was down -64.22%, and Tesla was down -65.03%. In the realm of finance, just as in life, leaning excessively on the few may well sow seeds of unforeseen outcomes.

If navigating the stock market’s complexities feels like a challenging journey, do not hesitate to seek guidance from a financial planner. Their expertise can help tailor your investment strategy to your unique situation and help avoid making short-term reactionary decisions with long-term consequences.

Schedule an introductory phone call with Mark at this link: Mark Brinser – Introductory Phone Call

Like this article? Check out our Investing Archives where we provide insights to help you weather changes in the market.